Child Support

Today in Illinois, child support is calculated with an income share model, rather than a flat percentage based model. The concept behind an income share model is that the Court considers the incomes of both parties, the amount of parenting time of both parties, and seeks to approximate the proportion of income that the child would have received if the parents were living together.

If you and your spouse have a combined net income of less than $500,000, there are four factors foundational that are taken into account for child support.

- The number of overnights with parent one

- The number of overnights with parent two

- Net income of parent one

- Net income of parent two

These factors are used to determine how much child support will be provided to the parent who has the greater amount of parenting time. The financial support is focused on the best interest of the child and is meant to make sure child-related expenses are provided: housing, medical expenses, clothing, tuition, other educational costs, and more.

In a traditional divorce process, those guidelines are more strictly adhered to, but for unique circumstances a judge can deviate from the formula. This standardized system often does not take into consideration the realities of all of the financial needs and financial goals of families.

By using the Collaborative Divorce process or Mediation, your family can follow the formulas or you and your team can make different determinations about child support and craft unique solutions for your family. If the formula works for your family, you can use it. But you’re also free to create a custom solution tailored to your family’s needs.

For families with children, Collaboration or Mediation allows all parties to have an open discussion about child support and parenting time in a way that benefits everyone.

Spousal Support

Spousal support (also called alimony or spousal maintenance) is typically provided to one party to help them maintain the standard of living they’ve become accustomed to. There are many factors that may be considered to determine how much spousal support will be awarded.

- Contributions to career advancement

- Earning potential

- Income and Property of each spouse

- Ongoing financial obligations of each party

- Parenting Time

- Prenuptial or postnuptial agreements

- Tax considerations

- Other applicable factors

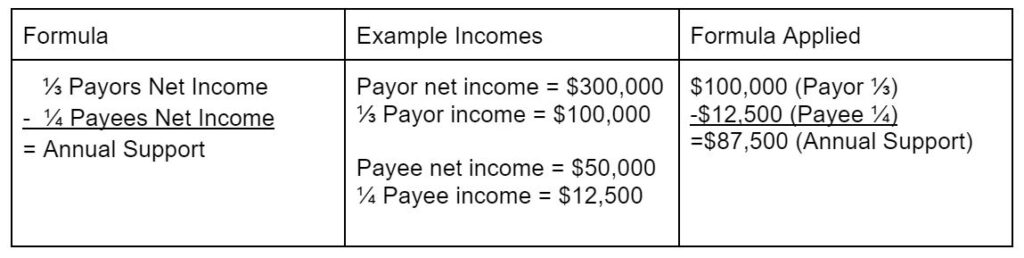

These issues are considered to determine whether spousal support is appropriate. If it is, a judge will use a formula, provided by Illinois law, to determine how much should be awarded. This formula is applied to couples who make a combined net income of less than $500,000.

One caveat with the standard formula is that the annual support cannot exceed 40% of the parties combined net annual income. If that were to occur, the annual spousal support would be lowered to meet that requirement.

The length of time that spousal support lasts depends on the length of the marriage. In addition, spousal support may be modified if one party’s circumstances change: increase or decrease in salary, getting remarried, or death.

Contact me to discuss child support and spousal support and how we can work within the Collaborative process to ensure solutions are made that are in the best interest of your family.

Collaboration or Mediation allows all parties to have an open discussion about child support and parenting time in a way that benefits everyone.

With Collaboration and Mediation, you will be able to deviate from the standard, rigid formula and craft more creative resolutions.